Section 199a Deduction 2025. To find the latest information on this topic, read final regulations of section 199a and guidance regarding trade or business determination for section 199a. What is the section 199a deduction?

Service businesses and the irc §199a deduction: It’s called the qualified business income deduction or often referred to as the section 199a deduction.

Tax reform legislation included a number of provisions of interest to partnerships and their partners including the section 199a deduction for qualified.

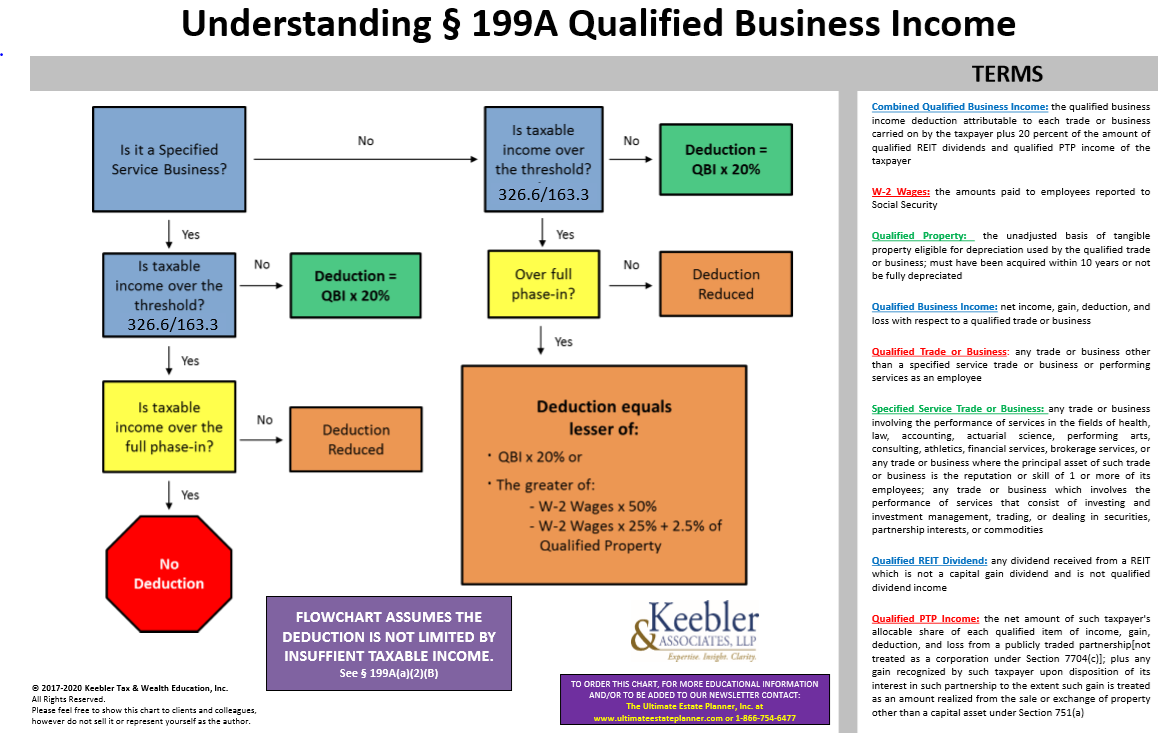

The new section 199a allows a deduction of up to 20 percent of a qualifying taxpayer’s qualified business income (qbi).

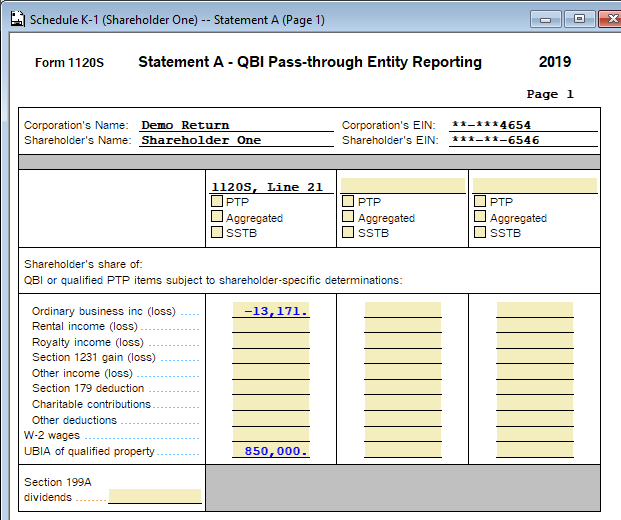

199A Worksheet By Activity Form Printable Word Searches, What businesses do not qualify for qbi deduction? If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section 199a (qbi deduction) attributes.

32 Amt Qualified Dividends And Capital Gains Worksheet support worksheet, It's called the qualified business income deduction or often referred to as the section 199a deduction. 199a deduction is limited to the lesser of $20,000 (20% of $100,000) or $14,000 (20% of $70,000, the excess of taxable income of $170,000 over net capital gain of $100,000).

Section 199A and the 20 Deduction New Guidance Basics & Beyond, One of the most beneficial tax provisions for. 199a deduction is limited to the lesser of $20,000 (20% of $100,000) or $14,000 (20% of $70,000, the excess of taxable income of $170,000 over net capital gain of $100,000).

Section 199A Deduction 2025 2025, If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section 199a (qbi deduction) attributes. The tax cuts and job act of 2017 (tcja) included a new 20% deduction, known as the qualified business income (qbi) deduction under irc section 199a, for sole proprietors and owners of pass.

Section 199A Flowchart Example AFSG Consulting, If you’re over that limit, complicated irs rules determine whether your business income qualifies for a full. If applicable, section 199a can lower the.

How is the Section 199A Deduction determined? QuickReadBuzzQuickReadBuzz, For single filers, the threshold for the 2025 tax year is $170,050, and for. The senate's version of section 199a, which permitted a deduction of 23 percent rather than the final law's 20 percent, is described in the conference committee report as.

How to enter and calculate the qualified business deduction, The income threshold for the section 199a deduction plays a pivotal role in its application. It's called the qualified business income deduction or often referred to as the section 199a deduction.

Section 199A Deduction 2025 2025, Taxpayers can include income from certain service businesses when calculating the deduction under. If you have any adjustments to unadjusted basis immediately after acquisition for depreciable assets enter them in the new section 199a (qbi deduction) attributes.

2025 Section 199A Chart Ultimate Estate Planner, 199a deduction is limited to the lesser of $20,000 (20% of $100,000) or $14,000 (20% of $70,000, the excess of taxable income of $170,000 over net capital gain of $100,000). In 2025, the limits rise to $191,950 for single filers and $383,900 for joint filers.

Section 199A Deduction 2025 2025, Tax reform legislation included a number of provisions of interest to partnerships and their partners including the section 199a deduction for qualified. The tax cuts and job act of 2017 (tcja) included a new 20% deduction, known as the qualified business income (qbi) deduction under irc section 199a, for sole proprietors and owners of pass.

The senate's version of section 199a, which permitted a deduction of 23 percent rather than the final law's 20 percent, is described in the conference committee report as.

Section 199a deduction allows for up to a 20% deduction against taxable income for shareholders, partners and members of manufacturing companies that pass.